Most people invest without a clear plan, relying on scattered advice, reacting to market trends, or managing multiple products without direction. This often leads to confusion, missed opportunities, and financial setbacks. Profito solves this by offering goal-based and expert-led financial planning through SEBI-registered investment advisors and experienced investment consultants. With personalised strategies, unbiased guidance, and a long-term vision, we help you cut through the noise and make confident, well-informed investment decisions that align with your life goals.

Profito offers investment planning through certified professionals registered with SEBI. Every strategy is built on sound principles, regulatory compliance, and a deep understanding of individual financial needs. Our advisors ensure that your investment decisions are ethical, structured, and aligned with long-term objectives, giving you clarity, consistency, and confidence in every stage of your financial journey.

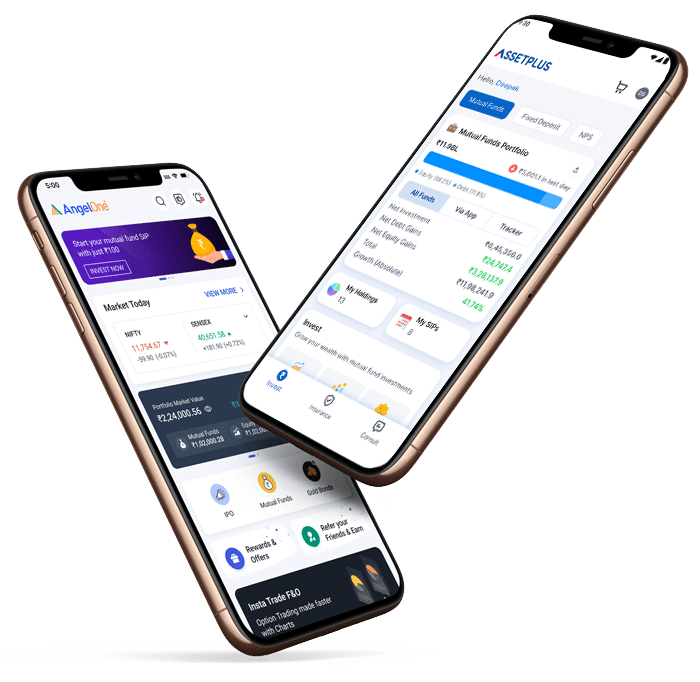

With Profito’s fully online model, expert financial guidance is now accessible across cities, towns, and remote locations. Our digital process includes secure onboarding, virtual consultations, and regular portfolio updates. You receive the same professional advice and personal attention as an in-office meeting, without geographical limitations or scheduling challenges, making quality advisory support both convenient and efficient.

Your financial goals are the foundation of our investment strategies. Profito advisors work closely with you to understand specific objectives such as retirement, home ownership, or education. Based on your risk profile and time horizon, we design balanced portfolios that evolve with your life. This ensures your investments remain focused, relevant, and capable of supporting your long-term aspirations.

At Profito, we maintain a strict advisory-only model with no incentives from product providers. Our financial recommendations are completely independent and rooted in your best interest. Whether selecting mutual funds or other instruments, our advisors provide objective analysis and full transparency, ensuring your financial plan is free from conflicts and structured to deliver lasting value.

Expert advice should be available to every investor, not just the affluent. Profito offers flexible advisory plans designed to suit various income levels and financial complexities. From beginners to seasoned investors, we provide professional support that is practical, affordable, and results-driven. Our focus is on enabling better financial outcomes through accessible and reliable guidance at every stage.

Many investors struggle with confusing advice, too many investment options, and plans that do not match their future needs. It can be hard to know who to trust. Profito helps by offering expert support from SEBI-registered investment advisors and certified financial planners. We create easy-to-understand plans based on your goals and risk comfort. There are no hidden charges and no product pushing. Everything is done online, with full support whenever you need it. That is why investors across India trust Profito to manage their money, plan better, and grow their wealth with clarity, confidence, and long-term support.

Profito, an AMFI-certified (Association of Mutual Funds in India) distributor,

partners with leading Asset Management Companies to offer trusted investment solutions across India.

Every investor’s goals and risk tolerance are unique. Profito builds personalised investment portfolios by analysing your income, future needs, and comfort with market fluctuations. Our advisors create a strategy that balances risk and growth while adapting to market conditions. This ensures your portfolio is aligned with your financial goals and evolves as your circumstances or ambitions change.

Profito provides expert mutual fund advice with zero consultation fees. Our SEBI-registered advisors recommend suitable funds based on your goals, risk profile, and investment horizon. We help you build a diversified and tax-efficient mutual fund portfolio with complete transparency. You get unbiased guidance without hidden charges, enabling smart investment decisions through a simple and secure online platform.

Tax planning is an essential part of effective investing. Profito helps you optimise your returns by selecting tax-efficient instruments that align with your financial goals. We guide you through deductions, exemptions, and investment structures that reduce liability while remaining fully compliant. Our approach ensures better post-tax income and helps you retain more of what you earn.

Whether you are planning for retirement, a child’s education, a property purchase, or wealth creation, Profito creates focused investment strategies around your specific goals. We translate your aspirations into measurable targets, supported by the right mix of financial products. As your goals evolve, our advisors adjust your plan to ensure consistency, clarity, and steady progress toward long-term success.

Managing debt effectively is essential for financial health. Profito helps you assess your current obligations and design structured repayment strategies. From credit card balances to long-term loans, we offer practical solutions to reduce interest burdens, improve cash flow, and protect your credit score. Our goal is to help you regain financial control and free up resources for future growth.

A strong portfolio requires more than returns; it needs protection against volatility. Profito uses asset allocation and diversification to manage risk effectively. We tailor strategies to your risk appetite, market outlook, and investment timeline. This disciplined approach reduces overexposure to any single asset or sector, helping you navigate uncertainty while maintaining consistent progress toward your financial objectives.

Investment plans are not set and forget. Profito offers continuous monitoring of your portfolio to ensure alignment with your goals. Our advisors review market trends, assess performance, and make timely adjustments when needed. This includes rebalancing assets, reviewing fund performance, and updating recommendations. Regular oversight helps you stay informed, reduce risk, and keep your investment journey on track.

Hourly-Fee Based

Automated Robo Advisor

Commission Linked Advisor

Starts from ₹3,000 per session

Starts from ₹15,000 annually

Starts from ₹5,000 per plan

Before making any investment plan, it is important to know where you stand. We start by understanding your income, monthly expenses, existing savings, and any loans or financial responsibilities you have. This gives us a clear view of your current financial situation and helps us create a realistic plan that fits your needs, lifestyle, and ability to invest without added stress.

Every successful financial plan starts with clear goals. We help you define what you want to achieve, whether it is saving for retirement, buying a home, or funding your child’s education. We look at both short term and long term priorities, then set specific targets for each. These goals become the foundation of your investment strategy and guide every decision we make together.

Investing always involves some level of risk, but not everyone is comfortable with the same amount. We help you understand your own risk tolerance by looking at your age, income, lifestyle, and financial responsibilities. Whether you prefer safer options or are open to taking more risk for higher returns, we use this profile to guide your investment choices and protect your peace of mind.

Once your goals and risk level are clear, we create a personalised investment plan. This may include a mix of equity, debt, hybrid, and real estate options based on your needs. We balance growth and stability while making sure your money is working efficiently. Every portfolio is designed to stay flexible so it can grow with you and adjust to life changes.

Financial plans need regular checkups to stay effective. We keep track of how your investments are doing, review them with you, and suggest changes when needed. This might include shifting funds, changing asset types, or adjusting targets based on market conditions. Our goal is to make sure your plan always supports your goals and delivers the best possible outcomes over time.

Financial investment plays a vital role in achieving life goals and long term security, especially in a growing economy like India. With rising costs and changing financial needs, planned investing is more important than ever. A Certified Financial Planner brings structure and clarity to this process. Guided by a Certified Financial Advisor in India, you receive tailored advice that helps grow your wealth steadily. At Profito, every Certified Financial Advisor offers transparent, goal-based strategies that are aligned with your needs. Smart investment decisions today ensure financial freedom, protection, and peace of mind for tomorrow.

A Registered Investment Advisor (RIA) is registered with SEBI and offers professional, unbiased investment advice. Unlike agents, RIAs work on a fee-based model and are legally required to act in your best interest.

If you want tailored advice based on your goals and financial situation, a Certified Financial Planner or Certified Financial Advisor in India is your best option. They help with investments, retirement, taxes, and more.

A Certified Financial Planner (CFP) offers comprehensive financial planning. This includes investment advice, tax planning, insurance, retirement planning, and estate management — all based on your life goals.

While self-investing is possible, a Certified Financial Advisor in India brings expertise, discipline, and a structured approach that reduces risk and avoids costly mistakes, especially in a complex market.

A CFA focuses more on investment analysis and portfolio management, while a Certified Financial Planner (CFP) offers broader financial guidance including insurance, tax, retirement, and estate planning.

You can check the SEBI website’s RIA directory to confirm if your advisor is officially registered. Profito’s advisors are fully SEBI compliant and transparent.

Yes, as long as they are SEBI registered or certified professionals like CFPs. Profito offers secure, goal-based online advisory services with certified experts you can trust.

Fees vary based on the service model. Some charge fixed annual fees, some charge per consultation. Profito offers affordable plans, and mutual fund advice comes with zero consultation fee.

Absolutely. Certified advisors create tax-efficient strategies using deductions, exemptions, and smart investments to help you save legally and improve your post-tax returns.

No, many advisors including those at Profito work with all types of investors, regardless of the starting amount. Good planning is for everyone, not just high-net-worth individuals.

Yes, retirement planning is one of the core services. CFPs assess future income needs, inflation, and investment options to help you retire with peace of mind.

It means building an investment plan around your real life goals like buying a house, children’s education, or retirement, instead of chasing short-term market returns.

At least once a year, or when your income, goals, or life situation changes. Profito offers ongoing portfolio monitoring and adjusts your plan whenever needed.

Yes, if they are certified and registered. Profito uses secure platforms and SEBI-registered professionals to ensure safe, transparent financial planning and advice.

Yes. Advisors can analyse your debt, suggest repayment strategies, and free up cash flow to help you get back on track and improve your credit health.

A CFA Certified Advisor brings deep knowledge in investment research, risk analysis, and asset allocation, which is especially useful for investors with larger or more complex portfolios.

Typically, ID proof, income details, investment history, and risk preferences are required. Profito’s onboarding is fully digital and hassle-free.

Yes, they assess your insurance needs and recommend suitable life, health, or term plans that protect your family without overpaying for unnecessary coverage.

It depends on your goals, but disciplined investing usually starts showing progress within one to two years. Long-term plans like retirement take consistent tracking and adjustments.

Because we offer clear, honest, and personalised advice from Certified Financial Planners and SEBI-registered advisors, all through a convenient online model that works across India.

Mutual fund investments are subject to market risks. Please read all related documents

carefully. Investments in securities are also subject to market risk. The value and return on investment may vary due to changes in interest rates, foreign exchange rates, or any other

reason.