Many investors want to build wealth but feel confused about where to start or how much to invest. Without a clear plan, SIPs often become random and inconsistent. Our SIP investment advisory helps you invest with structure, clarity, and purpose so your money works toward real financial goals.

A clearer way to invest through SIPs

Investing regularly is simple, but investing correctly is not. A Mutual Fund SIP works best when it is planned around your income, goals, and risk capacity. Our Systematic Investment Planning services help you move from guesswork to a clear investment roadmap that supports steady and disciplined wealth creation.

Frequent market ups and downs often make investors nervous. SIP planning reduces this stress by spreading investments over time and avoiding emotional decisions.

Many investors stop or pause SIPs during market corrections. A structured SIP plan builds consistency and keeps investments running even during uncertain phases.

Choosing funds without proper research can limit long-term growth, while SIP planning ensures your money is invested in quality funds aligned with your long-term financial goals.

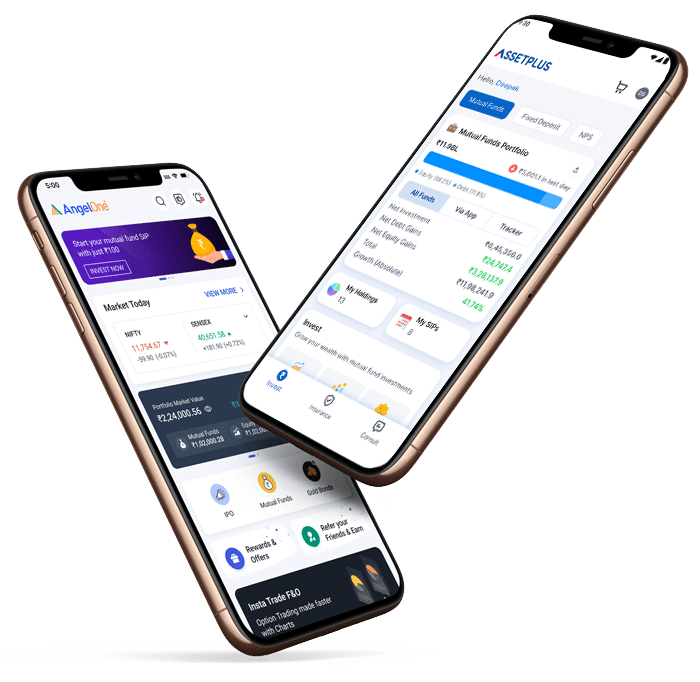

Profito is a certified financial advisory company and mutual fund distributor. We work in partnership with leading asset management companies and platforms such as Angel One, FundzBazar, Prudent, HDFC AMC, SBI Mutual Fund, ICICI Direct, Aditya Birla Mutual Fund, and Motilal Oswal.

Profito, an AMFI-certified (Association of Mutual Funds in India) distributor, partners with leading Asset Management Companies to offer trusted investment solutions across India.

Many advisors focus only on selling products. We focus on planning first. Our SIP investment advisory is based on understanding your financial situation, setting realistic goals, and guiding you through every stage of your investment journey with transparency and care.

Not every investor has the time, experience, or clarity to manage SIP investments on their own. Different life stages come with different financial challenges and expectations. SIP investment advisory helps bring structure and direction to investing by matching SIP plans with individual needs, goals, and risk comfort. Whether you are just starting out or already investing, the right guidance ensures your SIPs remain purposeful and consistent.

Profito helps reduce investment risks by spreading your money across various assets, ensuring balanced and stable returns. Instead of relying on a single investment, we create a diversified portfolio for you. This approach protects your wealth from market fluctuations while optimising growth opportunities for a secure financial journey.

With Profito’s Mutual Fund Investment Advisory Services, you don’t need to worry about tracking markets or making investment decisions alone. Our experienced fund managers use research-driven strategies to manage your investments effectively. We handle market analysis and risk management, ensuring your funds are optimised for long-term growth while you focus on your life’s priorities.

Profito ensures you have financial flexibility. Need funds? Withdraw easily without unnecessary restrictions. Want tax benefits? Our ELSS funds help you save under Section 80C while building wealth. With a combination of high liquidity and smart tax-saving strategies, we help you maximise returns while keeping your finances stress-free.

Starting an SIP is easy. Keeping it aligned with your goals over the years is not. Profito focuses on structured planning and steady guidance so your SIPs remain relevant, balanced, and consistent as markets and life situations change.

We design SIP strategies after understanding your income, responsibilities, and future plans. This ensures your investments feel manageable today while staying effective for long-term outcomes.

Investing should not feel complicated or uncertain. We keep SIP execution, monitoring, and communication clear so you always understand your investments and stay confident in your decisions.

A simple monthly SIP, even with a modest amount, can help you work toward meaningful goals over time. You don’t need to invest heavily at the start. What matters is consistency and the right guidance. Let Profito help you plan it the right way.

Use Profito’s SIP Calculator to see your potential returns instantly.

Estimation is based on the past performance

The total value of your investment after 1 Year will be

Yes. Our SIP investment advisory is designed specifically for long-term wealth creation by aligning your investments with clear financial goals, time horizons, and risk comfort.

Absolutely. SIP planning is ideal for first-time investors because it simplifies investing, removes guesswork, and helps you start with confidence and discipline.

We help you choose the right funds, decide the correct SIP amount, and maintain consistency so your investments stay aligned with your income and goals.

We focus on planning before products. Our approach starts with understanding your financial situation and continues with regular guidance and transparent support.

Yes. SIP advisory helps you stay disciplined during market ups and downs and avoid emotional decisions that can hurt long-term returns.

Funds are selected based on your goals, risk tolerance, time horizon, and fund quality, not trends or short-term performance.

Yes. If you already have SIPs, we review them, assess performance, and realign them if needed to ensure they still match your goals.

You can start SIPs with a modest monthly amount. The focus is on consistency and correct planning rather than starting with a large investment.

Yes. SIPs are one of the most effective tools for retirement planning when started early and reviewed regularly.

Yes. We help plan SIPs for long-term goals such as child education, higher studies, and other major life milestones.

SIP investments are reviewed periodically to ensure they remain aligned with market conditions, goal timelines, and changes in your financial situation.

Your SIP plan can be adjusted. We help increase, reduce, or restructure SIPs based on life changes so investments remain comfortable and sustainable.

No. SIP investing does not require daily market tracking. Our advisory ensures structured monitoring and timely guidance.

All market-linked investments carry risk, but SIPs help reduce timing risk and smooth volatility when planned correctly and held long term.

Yes. SIP advisory is especially useful for working professionals who want disciplined investing without spending time tracking markets.

Yes. We provide ongoing monitoring, reviews, and guidance so your SIPs stay relevant over time.

Yes. Profito is an AMFI-certified mutual fund distributor and works with leading Asset Management Companies in India.

You can start by opening a zero-cost Demat or Mutual Fund account through our partnered platforms and begin SIP planning with expert guidance.

Mutual fund investments are subject to market risks. Please read all related documents

carefully. Investments in securities are also subject to market risk. The value and return on investment may vary due to changes in interest rates, foreign exchange rates, or any other

reason.